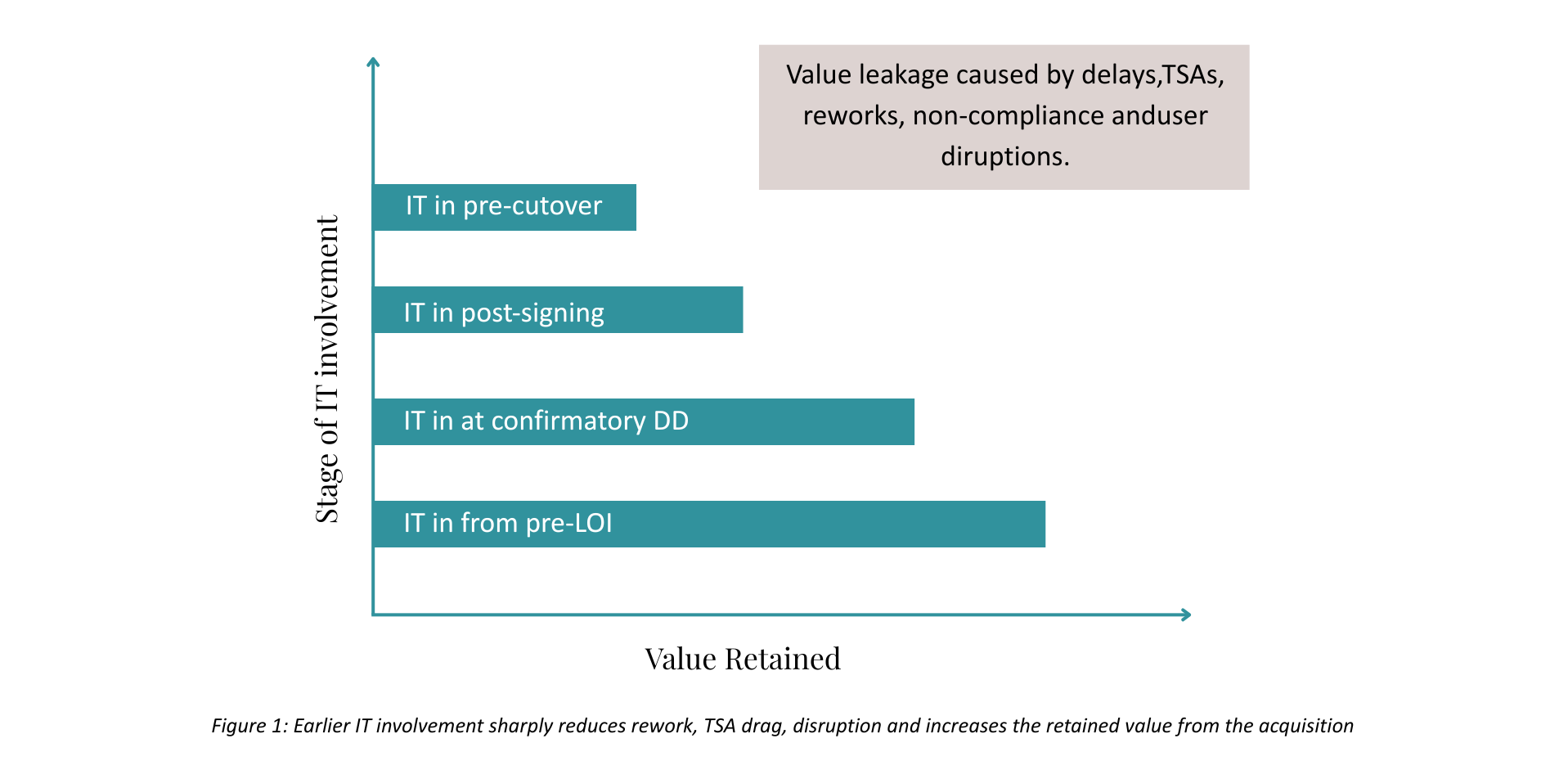

Acquisitions are ultimately judged on whether the promised value and cost savings shows up in the numbers reliably, quickly, and without unpleasant surprises. In many deals, a large share of the business case for IT rests on the cost-out opportunities from eliminating duplicate systems, reducing vendor spend, simplifying the IT landscape, but these opportunities only materialise when IT is involved early enough to shape decisions. Yet in too many deals, IT is invited in only after key terms are set, term sheets negotiated, transitional service agreements (TSAs) sketched and Day-1 assumptions pencilled in. By then, choices with multi-million impacts have already hardened. Integration teams inherit constraints they didn’t shape. “Just make it work” replaces disciplined planning and integration only brings frustration, delays and little accountability. Ultimately, resources becomes strained, quality is comprised and unplanned costs becomes unavoidable.

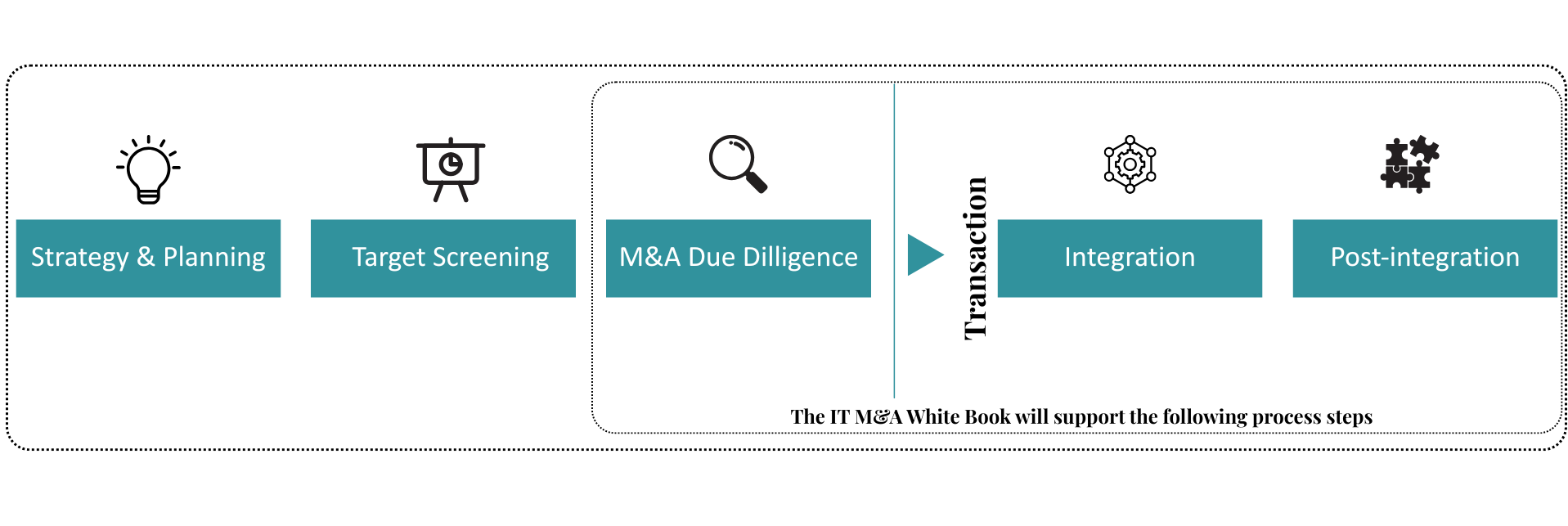

This article explains what goes wrong when IT joins late, the benefits of involving IT early, and how the IT M&A White Book by Opticos structures the work along the three natural phases of a deal: Due Diligence, Integration, and Post-Integration so that what you buy is what you can operate, improve, and prove.

The Issue: IT Arrives Late, Risk Arrives Early

When IT is absent early, the business case starts on a shaky foundation. Four recurring failure modes account for most of the avoidable cost, delay, and disruption we see:

1) Invisible dependencies: Applications rarely live in tidy boxes. They depend on shared directories, data feeds, payment gateways, analytics layers, and monitoring tools. If identified after signing, they create rework, partial cutovers, or extended TSAs – all of which add cost and delay.

2) Weak TSA positions: Negotiating TSAs without IT input leads to paying for the wrong services, unrealistic exit timelines, and service levels that don’t support integration. Extended TSAs often become one of the biggest unplanned cost drivers.

3) Compliance gaps surface late: Every deal must satisfy applicable regulatory and statutory requirements. When gaps are identified only after close, remediation must happen under time pressure, increasing both cost and risk.

4) Day-1 becomes “day-maybe”: Without a defined Day-1 target operating model, the basics wobble: who has access, how tickets are handled, what comms go to whom, where data flows, whose laptop still authenticates. When Day-1 is unstable, value capture and cost-efficiency efforts stall before they begin.

The Benefits: Early IT Involvement Speeds Deals and Saves Cost

Bringing IT to the table from the very beginning delivers three classes of benefits:

Deal clarity: Early discovery uncovers critical interfaces, data obligations, vendor entanglements, and control baselines. Leaders can then set integration ambition, timing, and cost-out potential based on facts rather than optimistic assumptions.

Execution speed: A clean hand-off from diligence to delivery compresses timelines. With clear Day-1 scope, workstreams can move in parallel. Identity and access, data migration, service desk, and supplier changes are sequenced with the people impact in mind. You trade last-minute heroics for predictable progress.

Durable outcomes: Post-close, benefits realization doesn’t happen by accident. With early IT involvement, the plan includes who owns each synergy, how it is evidenced, when legacy risk is retired, and which activities (like decommissioning) close the loop. Cost-out becomes part of the structured plan rather than a vague future aspiration.

The IT M&A White Book by Opticos: Built Around the Three Phases that Make or Break Value

The IT M&A White Book is a pragmatic guide and not a rigid methodology that keeps speed and control in healthy tension. It is structured around what actually happens in deals: discover → deliver → demonstrate. Below, we outline the three phases and the problems buyers typically face. The White Book is designed to address these problems directly, so your teams spend less time reinventing and more time executing.

1) Due diligence: Reduce surprises before they become costs:

In the rush to secure a deal, technology risks often stay under the surface. Buyers underestimate the web of systems and data flows that underpin license-to-operate processes. Vendor contracts hide renewal cliffs, audit exposure, and auto-renew traps. Security and privacy controls may look good on paper but lack evidence of operating effectiveness. TSAs get drafted as legal conveniences rather than operational commitments. By the time these issues surface, they have already shaped price, timing, and scope.

How the White Book helps

It frames diligence as decision support, not document collection. It brings a lean governance rhythm, a focused evidence pack, and a clear translation of findings into Must-Have vs Should-Have integration scope. It sets up the TSA stance; which services are needed, for how long, at what standard–and the principles for exit. Most importantly, it identifies the early cost-out levers: which systems are duplicative, where vendor spend can be reduced, which contracts con be rationalised, and where consolidation or retirement is feasible. The output: an executive-ready integration decision that prevents nasty surprises after signing.

2) Integration: Make day-1 a non-event and cutover a disciplined change

This is where deals derail. Without an explicit Day-1 target operating model, practical basics falter: access, support, communications, and continuity. Workstreams run at different speeds with unclear dependencies. Identity, data migration, interim interfaces, and knowledge transfer compete for scarce subject-matter time. Vendors control key levers. When roles and escalation paths are fuzzy, issues linger; TSAs extend; users lose confidence.

How the White Book helps

It translates diligence decisions into a practical run-book owned by an Integration Management Office with the right decision rights. It defines Day-1 readiness in plain terms–who needs access to what, how tickets are handled, what changes are frozen, what comms go to whom–and provides simple mechanisms to keep identity, data, supplier, security, and service-management changes on one plan. It emphasizes people: onboarding, support, and change communications that make the transition safe for users, not just systems. It also synchronises integration milestones with cost-out actions, enabling early retirement of overlapping systems, alignemnt of contracts for renegotiation, and consolidation steps that can only happen once operational readiness is secured.

3) Post-integration: Prove the value, retire technical debt, close the loops

After the relief of cutover, many programs lose focus. Benefits tracking is inconsistent; ownership is diffuse; and the numbers are difficult to reconcile with the business case. TSAs that were meant to be temporary linger. Technical debt accumulates: duplicate applications that no one gets around to retiring, orphaned data stores, integrations left in “temporary” states, license inventories that don’t match usage. Compliance tasks–like control evidence or policy harmonization–remain open-ended, becoming audit findings later.

How the White Book helps

It provides a straightforward approach to proving the value–what to measure, how to attribute, and how to avoid double-counting. It organizes decommissioning and remediation into a credible plan with owners and checkpoints, not an ever-growing backlog. It schedules TSA exits as milestones, not wishes. Crucially, the White Book treats post-integration as an intentional cost-out phase: a structured program to eliminate duplicate systems, consolidate infrastructure, reduce license volumes, streamline vendors, and simplify architectures. This shifts cost reduction from a vague ambition in to a predictable, auditable sequence of actions with visible financial impact. And it builds a habit of capturing lessons learned so your next integration benefits from this one. The aim is simple: leave a tidy, well-run IT landscape that supports the combined business and delivers the cost savings and value that justified the deal.

What “Good” Looks Like

- Clarity over complexity: Keep just enough structure to prevent surprises and enable decisions. Lists, run-books, and roles should be short and clear.

- Speed with control: Momentum matters. Use a lean cadence and explicit decision rights so material choices–system consolidation, TSA commitments, cutover scope–are made at the right level and at the right time.

- Outcomes, not activity: Day-1 is about continuity; cutover is about safe change; post-integration is about proving the business case and retiring risk. Each step has entry and exit criteria and a named owner.

- People first: Users remember whether they could do their job on Day-1, whether support responded during hypercare, and whether communications were straightforward. Technology succeeds when people are ready.

Bringing It All Together

Inviting IT into M&A late is like trying to fix the parachute after you’ve jumped. The avoidable leakage shows up as extended TSAs, rework, disruption, and compliance fixes on the critical path. By involving IT from the start, you gain deal clarity, execution speed, and durable outcomes–and you protect the one thing that matters: value realization.

The IT M&A White Book by Opticos exists to make that happen. It is built around the three phases where value is won or lost–Due Diligence, Integration, and Post-Integration and it is designed to solve the most common problems in each: reducing surprises before they become costs, making Day-1 a non-event and turning cost-out ambition into delivered,

evidenced savings while retiring technical debt and closing compliance loops. In short: discover what matters, deliver what’s needed, and demonstrate that it worked – both operationally, and financially.