In the ever-evolving landscape of sustainability, businesses are continually challenged to keep pace with new regulations, shifting policy timelines, and rising stakeholder expectations. Organizations must navigate complex reporting requirements, change in operations, and implementation of new sustainability policies. Failing to address these areas not only risks non-compliance and reputational damage but can also hinder access to capital, talent, and market opportunities.

Building on our previous publication “Navigating Sustainable Transformation”, this follow-up piece provides a concise overview of the recent EU sustainability regulatory developments, such as the Omnibus proposal and Stop-the-Clock initiative. Addressing associated risks of inaction, while drawing on trends and Opticos’ experiences to illustrate how to proactively address aforementioned challenges.

Recent Regulatory Developments

The EU Green Deal in Context

The EU Green Deal continues to be a legislative driving force behind sustainability initiatives in Europe, prompting companies to rethink how they operate. It introduces strict targets for reducing greenhouse gas emissions, accelerates the shift toward clean energy, and promotes a circular economy, in order to reach the goal of climate neutrality by 2050. For businesses, this may include actions redesigning products to meet new durability and recyclability standards under the Ecodesign for Sustainable Products Regulation (ESPR).

Since our previous article, one of the most notable developments is the introduction of the proposed Omnibus Bill in early 2025. This legislative package, currently under negotiation, was introduced by the European Commission in response to the growing concerns from businesses about the administrative burden and regulatory complexity of existing sustainability regulations. It aims to streamline and simplify several of the Green Deal’s complex regulations.

If adopted, the Omnibus Bill would revise key regulations of the EU Green Deal. The proposal suggests to ease/remove reporting requirements for small and mid-sized enterprises, while large companies (in the proposal newly defined as employees of 1000 or more) would still remain subject to reporting obligations.

In parallel, the Omnibus “Stop-the-Clock” proposal was approved and went into effect in April 2025, postponing sustainability reporting requirements. The reason behind the Omnibus proposal and Stop-the-Clock is to simplify and reduce the administrative burden on affected companies, but also to enhance competitiveness and attract investments through a more favourable business environment. However, the Omnibus proposal has also got criticism for dismantling some of the most important additions of the Green Deal, such as the due diligence requirement.

Key Regulatory Revisions Under Consideration

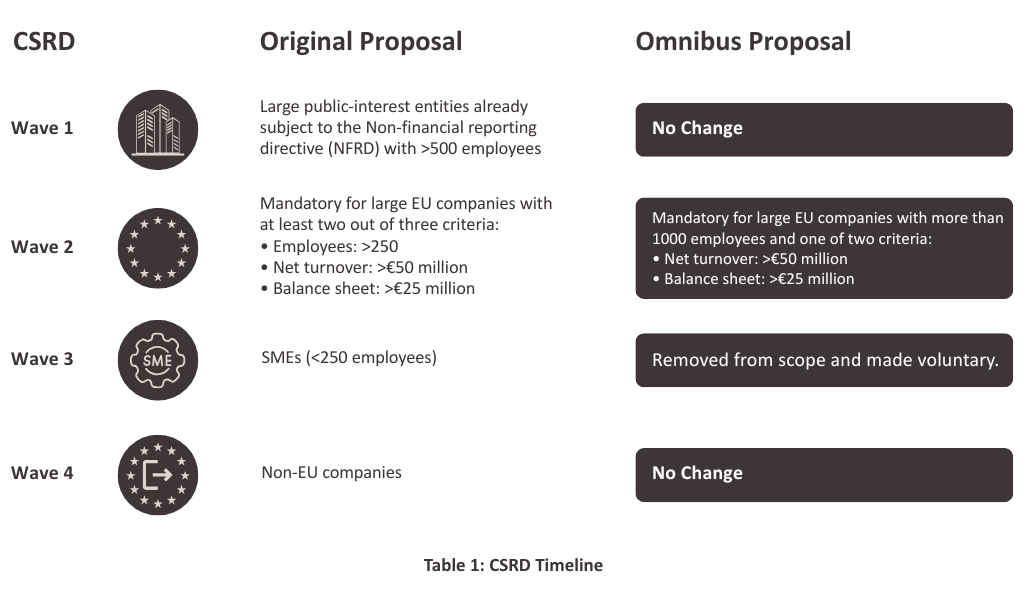

The Corporate Sustainability Reporting Directive (CSRD), which came into force in January 2023, was designed to improve the existing Non-Financial Reporting Directive by significantly expanding the scope of sustainability reporting. Considering the potential Omnibus package, reporting obligations would remain relevant to large companies, although the definition of a large company has been revised in the proposal. Hence, reducing the scope to about 80% of the companies included in the original proposal. Companies outside the scope may still voluntarily report. See table 1 for a summary of the changes.

The Corporate Sustainability Due Diligence Directive (CSDDD) holds companies accountable for their economic, environmental, and social impacts, including their entire Supply Chain, both upstream and downstream, in alignment with the EU Green Deal. Similar to the CSRD, the CSDDD may see reductions in reporting requirements if the Omnibus package is approved and implemented. One key change would be the elimination of the due diligence requirement across the full supply chain, reducing the scope to direct business partners (tier 1). Other Omnibus changes would include less frequent periodic monitoring exercises for due diligence and the removal of the clause for EU-wide civil liability regime that instead refers to national laws. See table 2 for a summary.

The “Stop-the-clock” admission, which has already been approved and gone into affect, means a postponed timeline for both the CSRD and the CSDDD. One year for CSDDD and two years for CSRD, as shown in figure 1 and 2. This is said to give companies in scope more time to prepare. However, the “Stop-the-clock” directive is only a temporary delay for the complex regulations to come. Regardless of whether the Omnibus proposal is adopted, the main goal of climate neutrality by 2050 is still in scope, placing great strategic emphasis on how organizations approach sustainability and sourcing, impacting everything from internal processes to sourcing strategies and supply chains.

From Compliance to Competitive Advantage

While the tangible impacts of new sustainability regulations are becoming increasingly evident, it is equally important to consider their broader, indirect effects. The heightened focus on sustainability is reshaping how companies are evaluated and compared. Organizations that fall behind risk being perceived as outdated or high-risk, whereas those that lead in this area can enhance their brand reputation among clients, partners, investors, and prospective employees. This is particularly relevant as younger generations, both as consumers and members of the workforce, place greater value on corporate sustainability.

However, momentum is uneven across regions and sectors, while sustainability efforts are gaining traction in many markets, others remain sceptical or resistant. This divergence may require companies operating in said markets to uphold regulatory commitments while tailoring messaging and product strategies to local contexts. Regardless of regional stance, sustainability will become a strategic consideration and a potential political signal for businesses to navigate.

Beyond compliance, embedding regulatory capabilities into scalable operations can unlock competitive advantages. One example is manufacturers internalizing the second-hand value chain. This approach not only reduces emissions per unit of revenue and enhances lifecycle data (critical for CSRD, ESPR, and DPP), but also captures margin and customer loyalty with certified resale and parts harvesting, otherwise lost to third parties. Effective models depend on reverse logistics, item-level traceability, and standardized refurbishment criteria. As noted by Hans Bergström, this strategy links incremental sales to products that have already accounted for most of their embodied emissions at the first sale.

Strategic Sourcing and SC in a Shifting Regulatory Landscape

From a sourcing perspective, companies will be held accountable for the sustainability performance of their value chains. For most companies, this require a reassessment of supplier relationships, including long-standing partnerships, with potential consequences such as renegotiations or even contract terminations if suppliers fail to meet new regulatory standards.

Explore how with our triple sustainability sourcing approach, an integrated framework designed to align sourcing practices with evolving compliance requirements, Opticos has supported organizations to align with the shifting requirements, make informed decisions, reduce exposure to compliance risks, and strengthen the overall resilience and integrity of their value chains.

As a complement to our Sustainability Sourcing Framework, we also use our Sustainable Supply Chain Assessment, an initial evaluation that helps organizations establish a clear baseline of their current sustainability maturity and readiness. It provides valuable insight into potential compliance gaps and improvement areas across the supply chain, enabling companies to prioritize actions and prepare upcoming regulatory requirements based on your specific situation.

Data as a Strategic Enabler

EU sustainability regulations are pushing companies to rethink product design, supply chains and sourcing strategies, introducing new layers of reporting and coordination that place significant demands on data infrastructure, management, and quality. In this environment, data becomes a strategic asset. Reliable and well-structured data is essential for meeting reporting obligations and provide the granular information regulators require. Without robust data foundations, companies risk incomplete reporting, compliance breaches, and reputational damage.

Grounded in client work, Master Data is the foundation of reliable sustainability reporting as every ESG figure, whether it is carbon emissions, material use, or supplier compliance, links back to core business objects like articles, suppliers, and customers. When the underlying data is inconsistent or incomplete, reporting becomes unreliable and hard to verify. For example, if a supplier appears under multiple names across systems, it is nearly impossible to track their sustainability performance correctly.

Achieving high quality Master Data it is not a clean up exercise, it requires a structured, governed foundation. In practice, this means clear ownership for key data domains, mapped and optimized Master Data processes, sustainability attributes (like emissions factors or material origin) embedded into existing data models.

At Opticos, we have delivered these capabilities in real-world projects. For example, mapping and designing end-to-end Master Data processes in global ERP rollouts, and acting as data stewards across multiple domains to formalise governance and policies that ensure consistency across systems. In sustainability focused initiatives, we have implemented data platforms to consolidate supplier and product data for CSRD aligned reporting. All these steps, ownership, process mapping, attribute integration, and governance, help organizations meet regulatory requirements and build long-term resilience.

Drawing on extensive experience in the data governance and architecture fields, Opticos helps organizations establish the data foundations needed to meet these evolving requirements. Enabling data driven decision-making, reducing compliance risks, and strengthened data security, ultimately positioning companies to respond proactively to sustainability challenges.

Conclusion

Even with postponed timelines and potential adjustment to the scope of sustainability reporting, waiting to act could become risky and costly. Instead, use this time to build robust internal processes, improve data quality, source and implement reporting systems before compliance becomes mandatory. Invest in ESG tools to help automate and consolidate data to keep it accurate, manual spreadsheets will not scale well as reporting requirement expands. Engage suppliers early, Supply Chain data is often very difficult to obtain yet critical for both CSRD and CSDDD compliance. Start mapping your supplier network now to allow time for reassessment and, where necessary, renegotiate contracts.

To conclude, the regulatory landscape continues to evolve, and sustainability is becoming a central part of companies business strategy, for regulatory alignment and for stakeholder trust. Recent developments around the Omnibus proposal, and the “Stop-the-clock” directive, highlights the need to remain informed and proactive. While such changes may offer temporary relief on timelines or scope, the EU Green Deal’s overarching objective of climate neutrality by 2050 still remains.

Explore how Opticos can help you assess readiness, strengthen data foundations, and optimize sourcing and supply chain strategies. Contact us to learn more.